Social Security Benefit Taxation

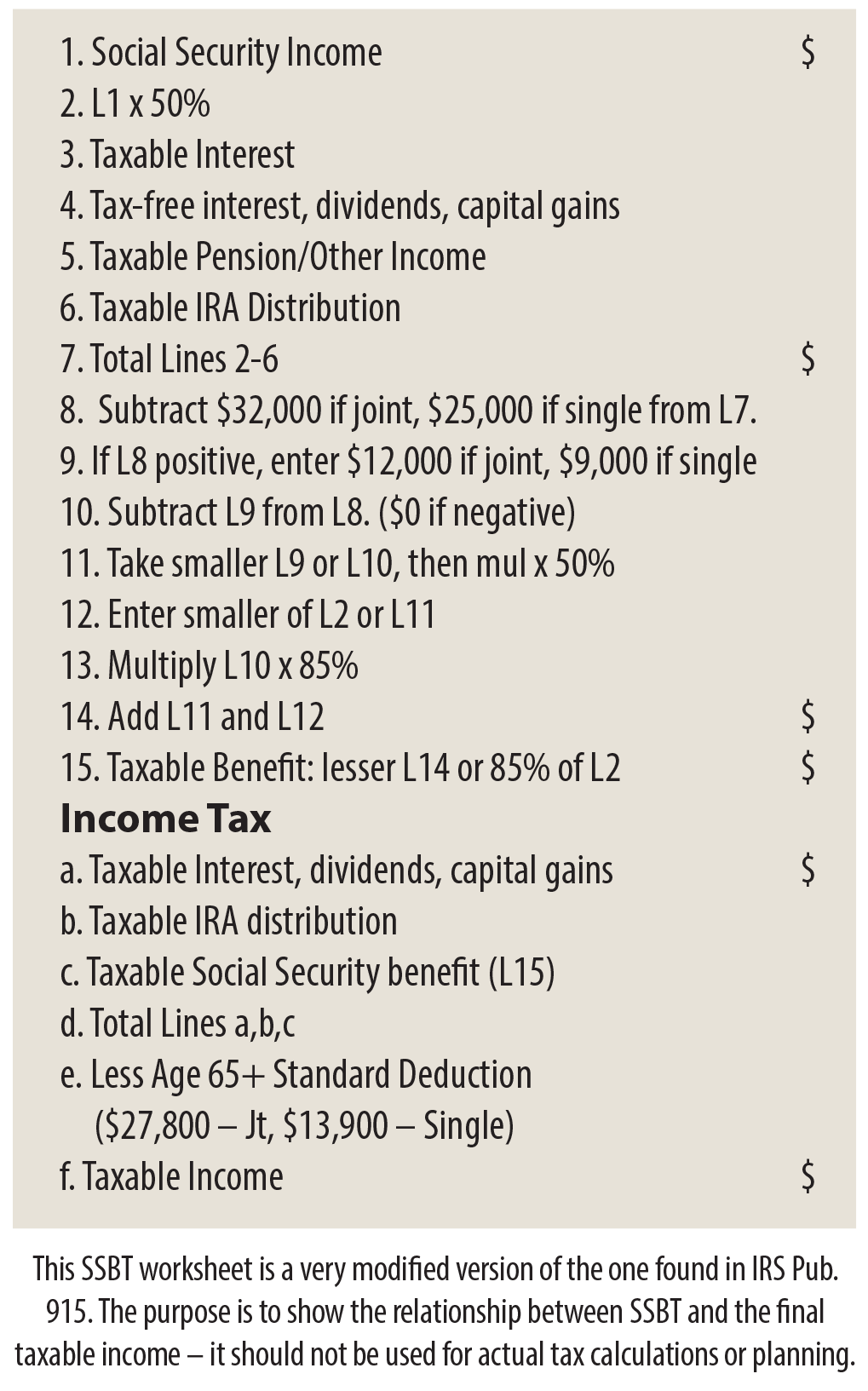

Social Security Benefit Taxation (SSBT) came about due to legislation passed in 1983 saying if your income exceeded a certain level ($32,000 for joint returns, $25,000 for singles), 50% of the benefit would be taxed. Ten years later the amount of benefits subject to tax was increased to 85% at income exceeding $44,000 for joint returns and $34,000 for singles. At the time only 18% of Social Security recipients had any of their benefit subject to taxes1. Unfortunately, unlike tax brackets, these benefit limits were not indexed to inflation, the result being more and more retirees had taxable benefits as years passed.

Social Security Benefit Taxation (SSBT) came about due to legislation passed in 1983 saying if your income exceeded a certain level ($32,000 for joint returns, $25,000 for singles), 50% of the benefit would be taxed. Ten years later the amount of benefits subject to tax was increased to 85% at income exceeding $44,000 for joint returns and $34,000 for singles. At the time only 18% of Social Security recipients had any of their benefit subject to taxes1. Unfortunately, unlike tax brackets, these benefit limits were not indexed to inflation, the result being more and more retirees had taxable benefits as years passed.

Whether you can avoid or lower taxes paid on the Social Security benefit can be easy to answer for some. If you’re filing joint with a total income of $150,000 or more, you’re going to be paying taxes on 85% of your benefit, or if joint total income is less than $50,000 the odds are good that none of your benefits will be subject to tax. If you’re single with a total income over $75,000 you’re going to be paying taxes on 85% of your benefit or if your total income is under $35,000 you probably won’t pay any tax on benefits. If your income is in the middle, whether you can lower taxes paid on your benefits depends on amount of the benefit and the source of the income.

In 2021 the median income for retired (Age 65+) couples was $56,6322. If every penny came from Social Security there would be zero taxes owed on the Social Security benefit. The reason why is only half of the benefit is used in the income calculation and this half is well below the $32,000 joint income threshold.

An Annuity Might Help

But if half came from the Social Security and the rest was from taxable interest and IRAs withdrawals, roughly 18% of the benefit is taxable. A zero federal income tax bill would now be $575.

In this case an annuity might help. For example, if $8,000 was coming from compounding taxable interest, moving the assets creating $4,000 of that interest into a fixed index annuity eliminates the tax because the interest is deferred and total income drops below the Standard Deduction amount.

A tax-deferred annuity lets the retiree decide when to take the interest and declare the taxable income – not the IRS. For savers it not only provides triple interest growth – simple, compound and tax-deferred – but perhaps a way to lower the tax paid on Social Security benefits.

1. HTTPS://WWW.SSA.GOV/HISTORY/TAXATIONOFBENEFITS.HTML

2 HTTPS://WWW.NEWRETIREMENT.COM/RETIREMENT/AVERAGE-RETIREMENT-INCOME-2021-HOW-DO-YOU-COMPARE/

Copyright 2021. Prepared for AMS Financial Services Group (AMS) by Advantage Compendium, Ltd for educational purposes only. Neither AMS nor Advantage Compendium, Ltd. provide investment, tax or legal advice. Information believed accurate, but is not warranted. Any views expressed are not those of AMS. Reproduction is not permitted without written permission. Fixed annuities typically have penalties for early withdrawal, known as surrender penalties, which may cause a loss of principal if the annuity is cashed in prematurely. Past performance is not an indication of future results. No index sponsors, promotes, or makes any representation regarding any index product. Both investments and fixed annuities involve certain risks; a consumer should consult with their advisor. Fixed annuities are not bank instruments and are not insured by FDIC.