Participation Rate versus Caps

The concept behind fixed index annuities (FIAs) is simple; using a fixed annuity means both principal and credited interest are protected from stock market risk, and linking potential interest to an external index may provide more interest than earning a fixed rate. Today, there are FIAs that base the interest earned on 35% of the annual index gain without caps or other limits. In certain market cycles, protecting what you already have and still getting some of the upside is a whole lot better than getting all of the losses and all of the gains.

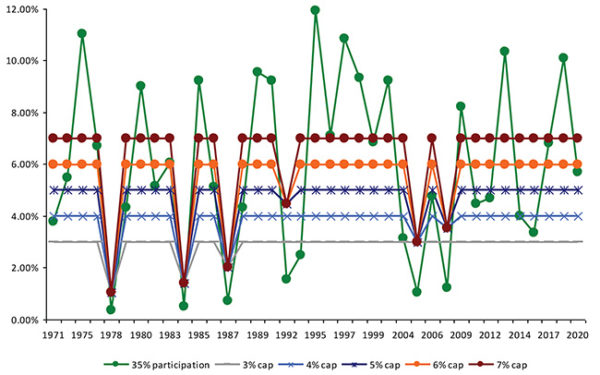

The question then becomes which interest crediting methods are better over time? Unfortunately, we don’t know what the future will bring, but we can hypothetically calculate how different methods performed in the past given certain assumptions. Since FIAs treat years with losses as year with zero gains, we can simply plug zeros into those years and focus on the up years.

Today, a strong FIA interest cap – maximum interest credited – is 4% or 4.5%. If you look at the same period and get all of the gain up to a 4.5% cap, but nothing beyond for each year, the average gain is a little over two-thirds of the average gain of an uncapped method using a 35% participation rate. If you apply a 3.5% cap the overall average annual capped gain is a little over half of what you would have averaged with a 35% participation rate.

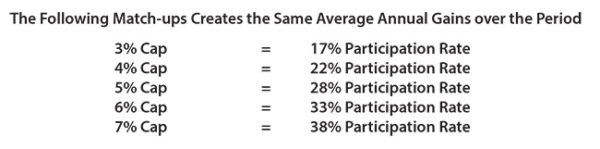

Let’s look at this from the other side. What uncapped participation rates were needed to match the average capped gains when you applied both crediting methods to positive years of the S&P 500 over the last half century? A 38% participation rate bit by a smidge a 7% cap, a 33% participation rate tied a 6% cap, a 28% participation rate equaled the average of the 5% cap, a 22% participation rate equaled a 4% cap, and a 17% one bested a 3% cap.

The Decision Is

Let’s look at this from the other side. What uncapped participation rates were needed to match the average capped gains when you applied both crediting methods to positive years of the S&P 500 over the last half century? A 38% participation rate bit by a smidge a 7% cap, a 33% participation rate tied a 6% cap, a 28% participation rate equaled the average of the 5% cap, a 22% participation rate equaled a 4% cap, and a 17% one bested a 3% cap.

For Financial Professional Use Only. Not for Distribution to the Public