Index Returns

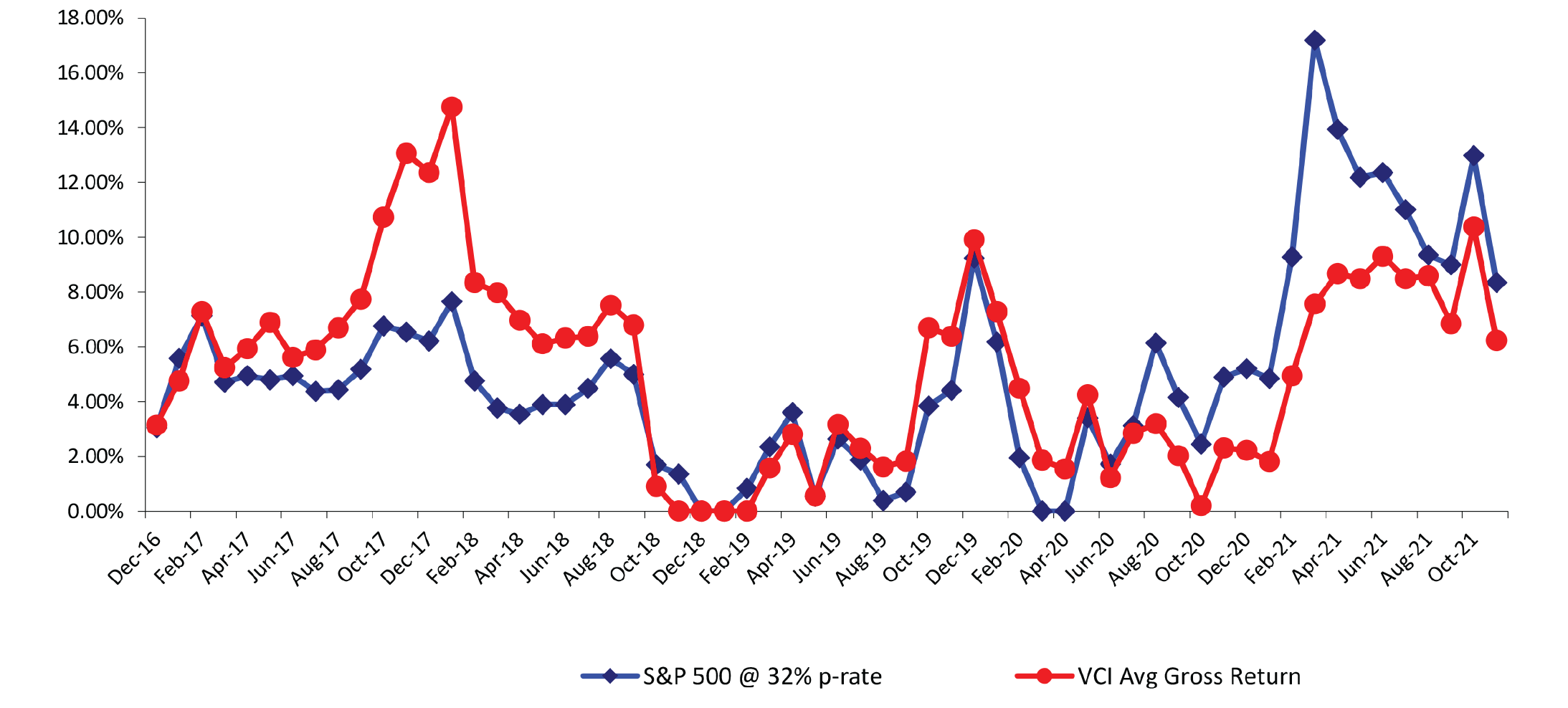

The chart compares the average twelve month returns for the 49 volatility control indices (VCIs) first offered in the fixed index annuity arena before December 2016, against the S&P 500 Index using a 32% participation rate for each period, from 2017 to 2021. Since the context is fixed index annuities, periods with negative returns are treated as zero return periods.

Overall, the chart shows when compared with the S&P 500 at a 32% participation rate, the VCI average returns outpaced S&P 500 returns in 2017, the S&P 500 returns were largely higher in 2021, and the middle years were mishmash.

For the entire five year period the average twelve month return for the S&P 500, when applying a 32% participation rate, was 5.07%. The average return for the VCIs was 5.32% – but this VCI average does not reflect the subtraction of any yield spreads or caps or lesser participation rates. All in all, the net average return for the VCIs would have been closer to 4.4%. If a 40% S&P 500 participation rate is used the average is 6.34%. On the other hand, the S&P 500 at a 25% participation rate produced a 3.96% rate.

The predictive power of this comparison on future returns is nonexistent. Even if the past market movements repeated, and we knew the future participation rates, spreads or caps, the dozens of newer VCIs added to the fixed index annuity arena are more likely to have index fees and use greater leverage than the earlier VCis compared here – which would greatly affect the net interest credited. Finally, no fixed index annuity offers an “Index of Volatility Control Indexes”. The typical FIA offers one or maybe a few VCIs – and the returns of individual VCIs vary greatly.

What does it mean? In a higher bond yield environment, where you can get 35% or better participation rates on traditional broad market indices, my hunch is it’s better to stick with the traditional indexes. If caps and participation rates on these indices are low, it’s worthwhile to consider a volatility control index. However, keep in mind that returns vary widely from one VCI to another and there’s no crystal ball.

Copyright 2021. Prepared for AMS Financial Services Group (AMS) by Advantage Compendium, Ltd for educational purposes only. Neither AMS nor Advantage Compendium, Ltd. provide investment, tax or legal advice. Information believed accurate, but is not warranted. Any views expressed are not those of AMS. Reproduction is not permitted without written permission. Fixed annuities typically have penalties for early withdrawal, known as surrender penalties, which may cause a loss of principal if the annuity is cashed in prematurely. Past performance is not an indication of future results. . “Standard & Poor’s” and “S&P 500” are trademarks of S&P Global Inc. and must be licensed for use. No index sponsors, promotes, or makes any representation regarding any index product. Both investments and fixed annuities involve certain risks; a consumer should consult with their advisor. Fixed annuities are not bank instruments and are not insured by FDIC.

For Financial Professional Use Only. Not for Distribution to the Public